Not quite ready to transact?

Subscribe to receive the latest resources for small business deals.

A search fund is an investment vehicle that allows individuals or groups of investors to pool their money together in order to acquire and operate a privately held company.

In the industry, people often refer to “searchers” as the lead operator who will be responsible for operating the business after acquiring it with the help of investors.

The model for traditional search funds was pioneered by Irving Grousbeck in 1984. His goal was to create a model to allow more people to become entrepreneurs. By using investor capital to fund the search and acquisition of a small business, searchers can afford to pay themselves a salary while looking for a business to acquire.

Why do entrepreneurs like the search fund model?

The upside of running a search fund is that an entrepreneur can use investor capital to purchase a business that they otherwise could not afford. Additionally, the presence of investors helps them navigate running and managing the business with the help of experienced advisors.

How long does it take for a search fund to acquire a business?

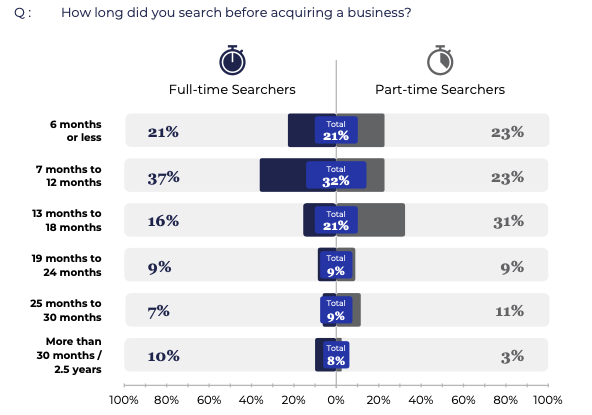

The search process can take several years, during which the searchers will typically conduct extensive research and due diligence on potential target companies.

According to the 2023 Self-Funded Search Study.com/study by Search Investment Group, a majority of searchers successfully find a business within 12 months, but some may take as long as 3 years.

Once a company is acquired, the search funders become the new owners and operators of the business, with the goal of growing and improving the company in order to generate a return on investment for the fund's investors.

Do all search funds end with an acquisition?

Unfortunately, no. Only around 1/3rd of “searchers” end up acquiring a business, regardless of whether they self-fund their search or set up a traditional search fund where investors fund their search.

Who are the investors in a search fund?

There are generally three types of investors in a search fund:

Friends and family of the searcher: These are individuals who are putting in small checks to help the operator acquire a business.

Professional investors: Firms like Trilogy as well as Search Investment Group are professional investors in the search fund world. Family offices often contribute to search funds as well.

Accredited investors: Additionally, high net worth individuals, such as doctors, lawyers, business persons, real estate professionals, are able to invest into search funds.

Sam Rosati has put together a list of search fund investors which can be accessed here.

What’s the difference between a self-funded and funded search fund?

In general, there are two types of search funds: a self-funded search and a traditional search fund.

In a self-funded search, the lead operator or “searcher” foots the bill of the search for a business. He or she is responsible for finding a business, fronting legal and transaction expenses, and pulling together investor capital when it’s time to transact. In exchange for being responsible for the search, self-funded “searchers” retain more equity in the acquired business. According to SIG, these “searchers” typically retain over 50% common equity ownership at closing.

In a traditional search fund, investor capital is raised before a business is identified. This allows the “searcher” to pay him- or herself a salary during the search phase, which can last well over a year. While this helps the “searcher” derisk spending time without a salary and maybe not transacting, it comes at a cost. In a traditional search fund, the searchers own less of the company that’s acquired and have less freedoms.

Not quite ready to transact?

Subscribe to receive the latest resources for small business deals.

Will is responsible for helping sellers market their businesses to prospective buyers and providing hands-on support from offer to close. Using his background in mergers and acquisitions at Wells Fargo, he drives value and provides clients with the necessary resources, best practices and advice for a successful sale of their business.

Information posted on this page is not intended to be, and should not be construed as tax, legal, investment or accounting advice. You should consult your own tax, legal, investment and accounting advisors before engaging in any transaction.

Calder Capital

Sam Domino