Explore your options

Get a 100% confidential and complimentary business valuation.

Transitioning a small business to a new owner can be tricky business. Not only are most small businesses very dependent on their business owners, but there are a number of parties involved in a business sale: employees, customers, suppliers, partners.

Nailing the transition is a win-win. For retiring owners, they are able to set the business on a course for success and ensure they aren’t dragged back in within months of the sale. For new owners, they are able to keep the lights on and get off to the races, building upon the previous owner’s success while ensuring the business lives on under new ownership.

Key to ensuring a successful turnover of ownership is a transition plan. A good transition plan guarantees a successful transition.

What is a Transition Plan?

A transition plan outlines the process of transitioning a business from one owner to another. Regardless of whether the new owner is a previous employee or a new MBA graduate buying the business from the original owner, the transition plan is a crucial tool.

In the transition plan, there is typically a set of priorities and objectives tied to a timeline. For instance, the first week may be focused on introducing the new owner to key employees, customers, vendors and suppliers. The second week may be focused on onboarding the new owner to tasks that the original owner was uniquely qualified to perform: job estimates, new sales, etc.

Behind any good transition plan, there should be a set of success criteria. At the end of the transition, what needs to be the case? The new owner can do all estimates? Employees no longer rely on the owner for edge cases, as the new owner has hired a consultant to advise?

What’s Important to Cover?

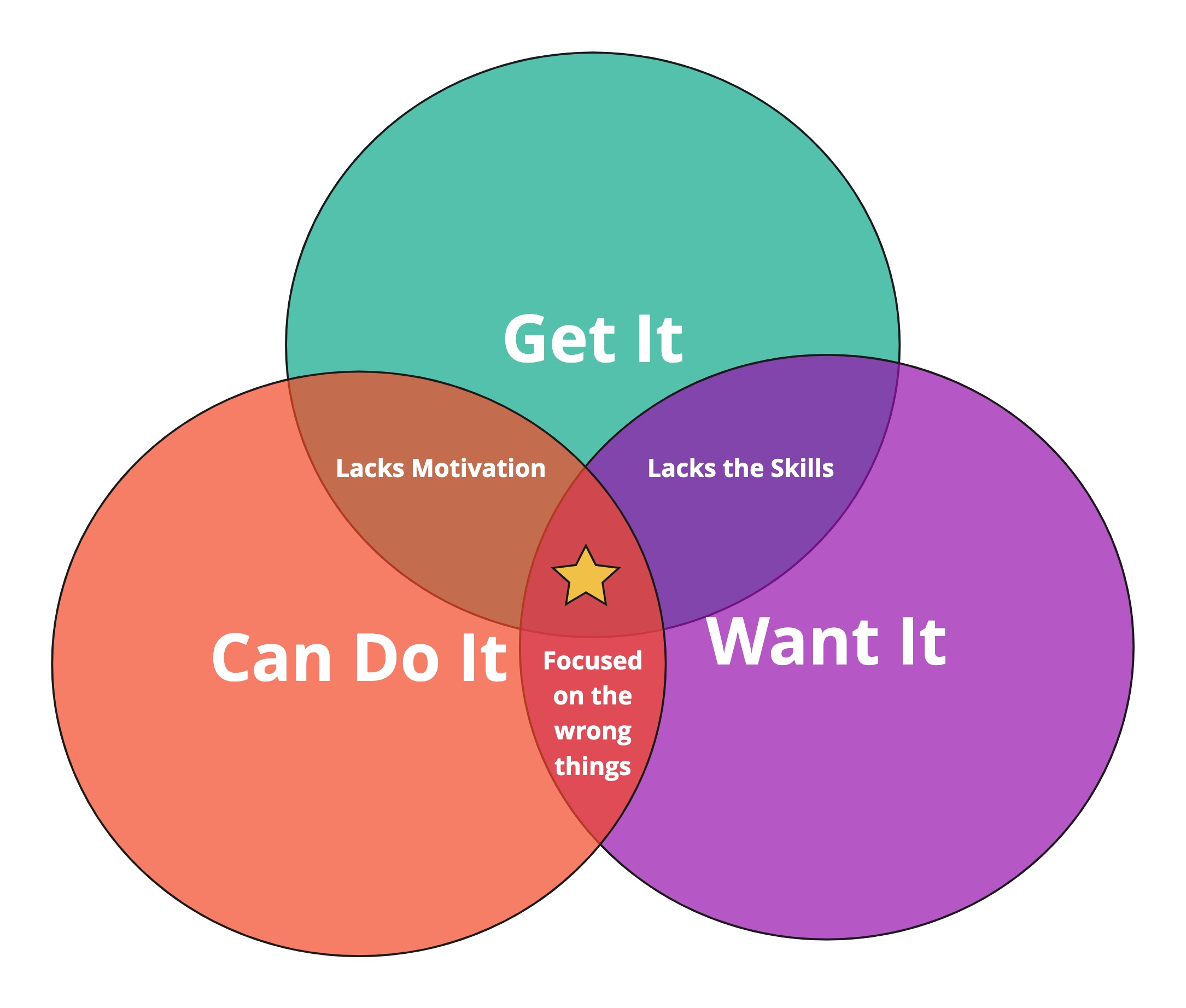

The framework we like is from the book Traction by Gino Wickman. It’s called GWC: Get It, Want It, Capable to Do It. Below we outline a small graphic explaining it. Essentially, a new owner has to “get it”, “want it” and be able to do it.

The purpose of the transition is to make sure the new owner “gets” it and is “able” to do it. Said another way, the selling owner should make sure to spend time covering the higher level context while spending time in the weeds on the important stuff that the new owner needs to be “able” to do.

In a business transition, whether to family members or a new buyer, there is a lot of responsibility that the old owner needs to hand over:

Running payroll and managing benefits

Handling estimates and bids for new projects

Hiring employees and being the “bar raiser” for the company

Setting up and managing a “board of directors”

In our mind, the ideal transition period focuses most of its time on the highest risk activities. For instance, estimation is part art and part science. It can make or break a business. If you overestimate, you’ll rarely win a bid. If you underestimate, you’ll be losing money from day one. New owners should focus as much time as possible on de-risking the key “go to zero” risks in a business.

How Does the Seller Get Compensated?

Most of the time, the first 30 days are “included” in the business transaction. Why? Without that, the entrepreneurs aren’t really buying a going concern. The buyer needs to learn how to run the business in order to be able to earn the cash flows that the business has generated historically, which is exactly the basis for the purchase price.

Beyond the first 30 days, there are a number of ways to structure compensation.

Sometimes, we see the owner of a family business have a consulting agreement for a period of 12 months. This is common when they have domain expertise that the buyer may lack. By structuring a paid consulting agreement, the buyer can incentivize the owner to help him or her out as she runs into edge cases that were beyond the scope of the original succession plan.

Other times, the retiring owner will have a performance-based compensation scheme after the first 30 days. Perhaps the new buyer is slightly weaker on sales and wants to pay the new owner 6-10% of all new work sold until he or she can get their feet under themselves.

Interested in buying a small business?

Subscribe to our Listing Alerts for early access to new listings.

Will is responsible for helping sellers market their businesses to prospective buyers and providing hands-on support from offer to close. Using his background in mergers and acquisitions at Wells Fargo, he drives value and provides clients with the necessary resources, best practices and advice for a successful sale of their business.

Information posted on this page is not intended to be, and should not be construed as tax, legal, investment or accounting advice. You should consult your own tax, legal, investment and accounting advisors before engaging in any transaction.

Calder Capital

Sam Domino